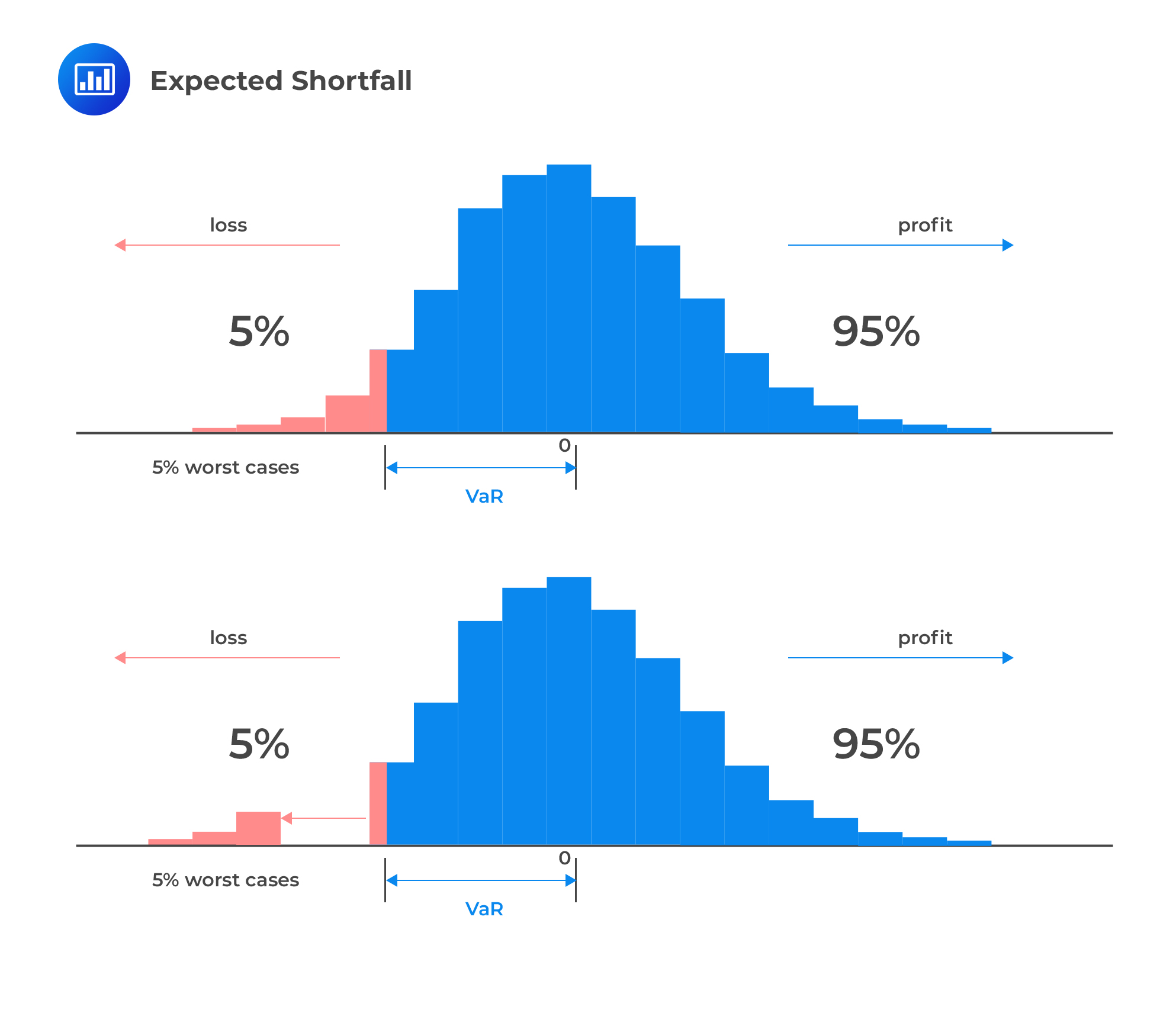

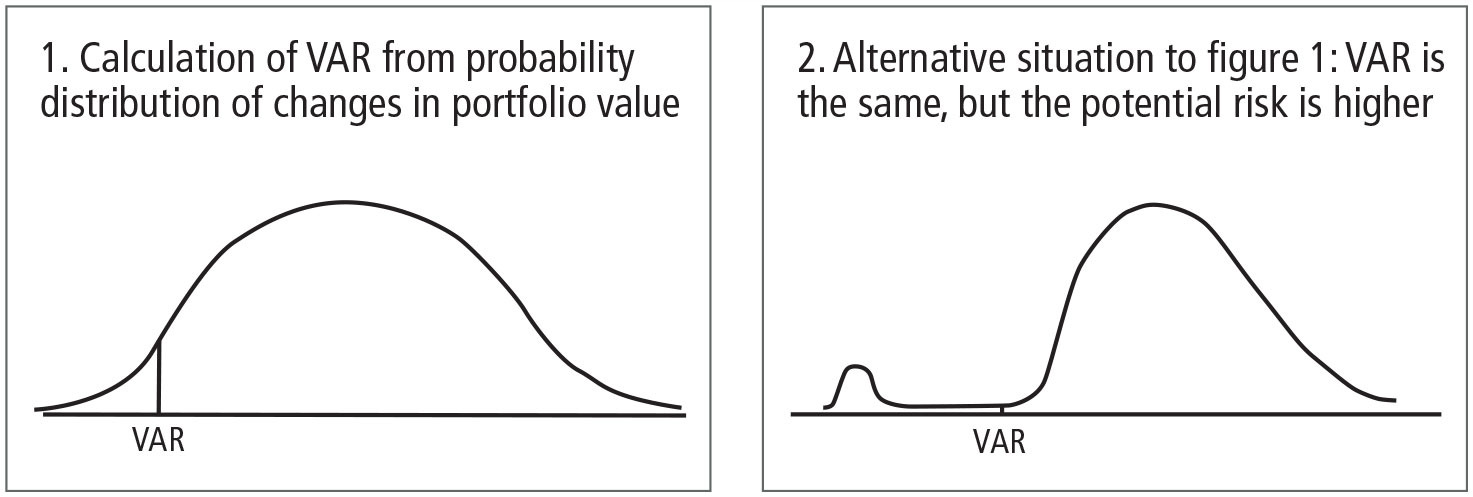

Expected Shortfall and Value-at-Risk. In case of Expected Shortfall the... | Download Scientific Diagram

Article 325bb Expected shortfall risk measure | Regulation 575/2013/EU - Capital Requirements Regulation CRR (UK CRR as onshored by HM Treasury) (Retained EU Law) | Better Regulation